Nvidia to Resume AI Chip Sales in China as US Eases Export Curbs

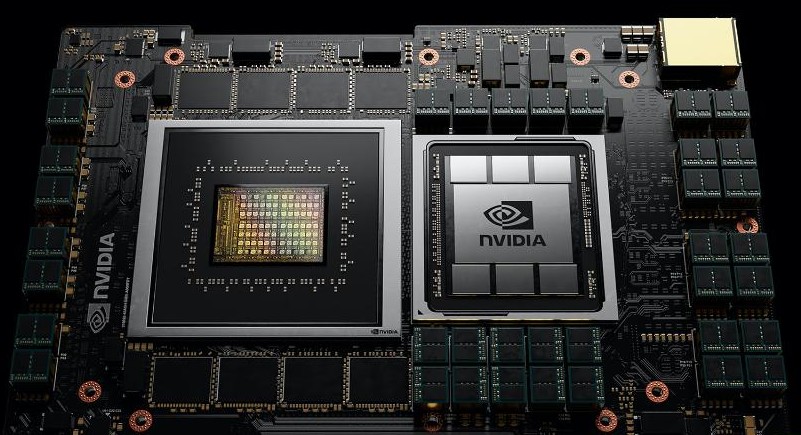

Photo Credit: @nvidia

US semiconductor giant Nvidia has announced it will restart sales of its H20 artificial intelligence (AI) chips to China after receiving assurance from the US government that required export licences will be granted. This decision marks a key shift in trade policy and is expected to strengthen Nvidia’s presence in one of its most important global markets.

The H20 chip is a specially designed version of Nvidia’s advanced AI processors, created to comply with US export restrictions aimed at preventing China from acquiring high-end technologies with potential military applications. These restrictions had paused sales earlier this year when tighter licensing rules were implemented under the Trump administration.

On Tuesday, Nvidia confirmed that it is filing applications to resume sales of the H20 GPU and expects deliveries to begin soon. CEO Jensen Huang expressed optimism, saying he looked forward to bringing the chips to Chinese customers. His comments were shared in a video released by Chinese state broadcaster CCTV.

Huang is also set to attend the 3rd China International Supply Chain Expo on July 16, in what will be his third visit to China this year. His attendance underlines Nvidia’s continued interest in deepening its engagement with the Chinese market despite ongoing geopolitical tensions.

China remains a crucial growth market for Nvidia, even as the company faces increasing competition from domestic tech players like Huawei. The US export restrictions had given an edge to local firms, while Beijing criticized the curbs as barriers to its technological progress.

During a previous visit to China in April, Huang reportedly conveyed to Chinese officials his commitment to contributing positively to US-China trade ties and further investing in the country’s tech ecosystem.

There are also reports that Nvidia plans to establish an R&D center in Shanghai, although this has not been officially confirmed. The announcement comes at a time when China’s economy is navigating challenges, including a real estate crisis and weak consumer spending, even as it posted a 5.2% GDP growth in Q2 2025.

Source: The Economic Times