Micron Warns Global Memory Chip Shortage Could Stretch Beyond 2026

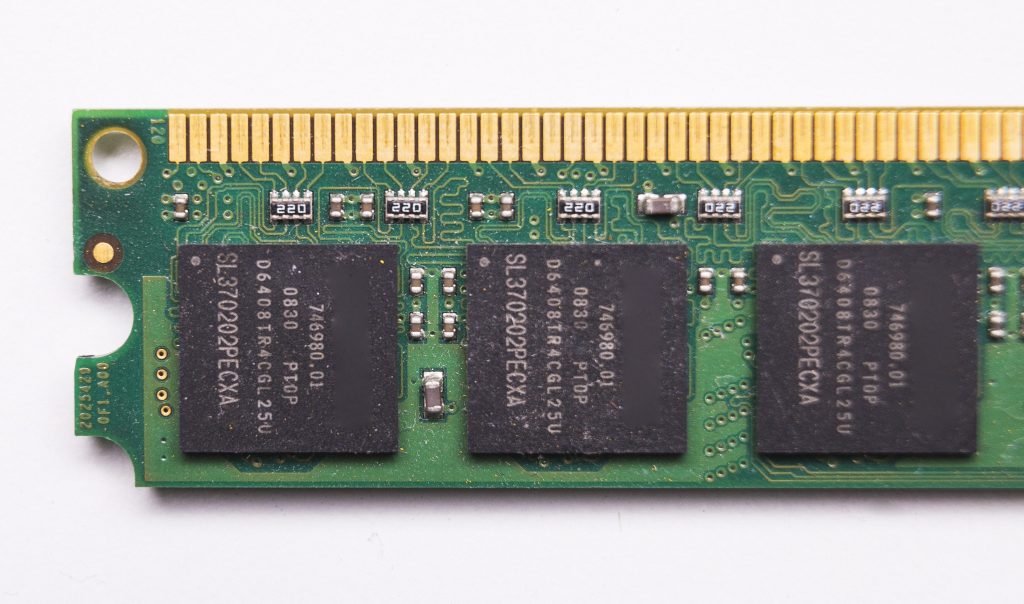

Micron Technology has warned that the global shortage of memory chips has reached an “unprecedented” level and is expected to continue well beyond 2026, driven mainly by soaring demand from the artificial intelligence sector. The US-based chipmaker said the rapid expansion of AI infrastructure is absorbing a large share of the world’s available memory capacity, leaving limited supply for traditional markets such as smartphones and personal computers.

According to Micron, high-bandwidth memory used in AI accelerators is consuming so much production capacity that other segments are facing serious shortages. As a result, manufacturers of PCs and smartphones are now trying to secure long-term supply contracts for memory chips even after 2026. This situation has added pressure across the electronics industry, as rising memory prices increase production costs and affect shipment plans.

The impact is already becoming visible. Some major Chinese smartphone brands have reportedly reduced their shipment targets for 2026 due to higher memory costs. Industry researchers have also estimated that global smartphone shipments could decline next year as shortages squeeze supply and push up prices. PC makers have issued similar warnings, saying limited availability of memory chips could affect future product launches.

The three largest memory chip makers—Micron, Samsung Electronics, and SK Hynix—have benefited from the AI boom, with strong demand pushing their production lines close to full capacity. SK Hynix has said its chip output for 2026 is already fully sold, while Micron has confirmed that its AI-focused memory products are fully booked for the current year.

To meet rising demand, Micron is accelerating its manufacturing expansion. The company recently announced plans to acquire a production site in Taiwan to speed up capacity additions in Asia, while major new wafer capacity will be built in the United States. Micron is also developing a large manufacturing complex in New York and expanding facilities in Idaho as part of its plan to shift 40% of its DRAM production to the US over the coming years.

Source: The Economic Times