India Eases Tax Rules for Foreign Tech Experts to Boost Electronics Manufacturing

In a major policy shift, India has introduced tax relief measures to attract foreign tech experts, particularly benefiting the electronics manufacturing sector. The Union Budget has proposed a presumptive taxation regime, under which only 25% of the remuneration earned by foreign professionals in India will be taxable.

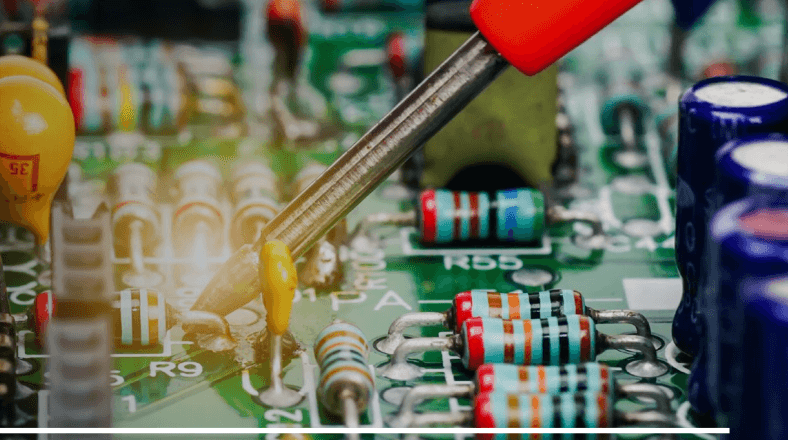

This move aims to address long-standing concerns among global electronics firms, which require highly skilled engineers and technicians to set up and operate factories, train local employees, and support manufacturing processes. Previously, foreign experts staying in India beyond 90 days faced complex tax compliance issues, discouraging many from working in the country.

The new taxation framework will provide greater predictability for businesses and aligns with India’s broader strategy to integrate into global value chains (GVCs). Finance Minister Nirmala Sitharaman also announced a safe harbour regime, offering long-term tax certainty for global component and sub-assembly vendors storing their inventory in India.

Industry leaders welcomed these reforms, emphasizing their potential to enhance India’s global competitiveness. “This is a crucial step towards making India a preferred destination for electronics manufacturing,” said Pankaj Mohindroo, Chairman, India Cellular and Electronics Association (ICEA).

Additionally, the government has scrapped the 2.5% tariff on key smartphone components, including PCBAs, camera modules, connectors, and fingerprint scanners. Imports of capital goods for lithium-ion battery production will also be tax-free, fostering growth in the energy storage sector.

India’s electronics industry has witnessed remarkable expansion, driven by the Production-Linked Incentive (PLI) scheme. In FY24, the sector’s revenue exceeded $118 billion, with smartphone production reaching $52 billion and exports totaling $29.1 billion.

Source: The Economic Times