UNLOCKING INDIA’S CIRCULAR ELECTRONICS POTENTIAL: A PATHWAY TO SUSTAINABLE GROWTH

By Shambhavi Singh & Amit Kumar

One of the most frequently cited definitions of Circular Economy has been provided by the Ellen MacArthur Foundation which describes the concept as “an industrial system that is restorative or regenerative by intention and design. It replaces the ‘end-of-life’ concept with restoration, shifts towards the use of renewable energy, eliminates the use of toxic chemicals, which impair reuse, and aims for the elimination of waste through the superior design of materials, products, systems, and, within this, business models’’.

Circularity in the electronics industry transcends mere waste management; it embodies resilience, resource efficiency, and economic prosperity. India’s journey towards circularity has seen significant strides in the past decade, with the formulation of comprehensive policies and strategic initiatives. For example, the Ministry of Electronics & Information Technology (MeitY) is implementing the ‘Action Plan on Circular Economy in Electronics and Electrical Sector’ under the guidance of NITI Aayog. However, realizing the full potential of circular electronics demands a nuanced understanding of India’s unique context and a concerted effort to address key trade-offs.

This article delves into the evolving landscape of circular electronics in India, identifies critical findings, and proposes game-changing policy interventions to accelerate the transition towards a circular economy.

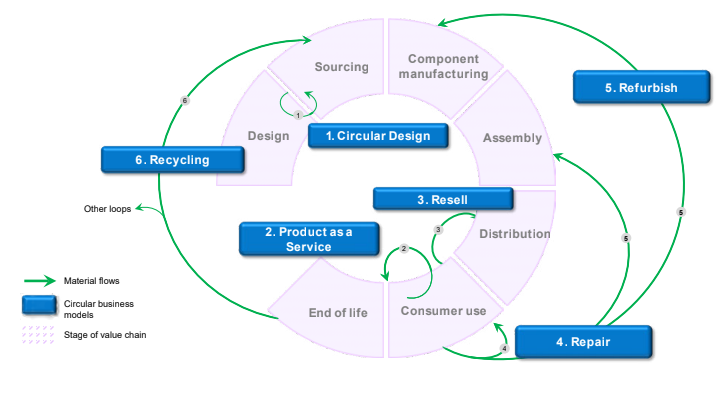

The Potential of Circular Electronics Business Models:

There are six circular business models in the electronics sector, namely, Circular Design, Product-as-a-Service (PaaS), Repair, Resell, Refurbishment and Recycle. The projected market size of these six in a business-as-usual scenario (based on existing commitments and targets) in 2035 stands at $13 billion whereas the total addressable market, if the right public and private sector actions were to be undertaken, is as high as $20 billion.

FIGURE 1: SIX CIRCULAR BUSINESS MODELS FOR ELECTRONICS INDUSTRY

Three of the six business models (repair, resell, and recycling) are currently widely used, with the informal sector playing a significant role.

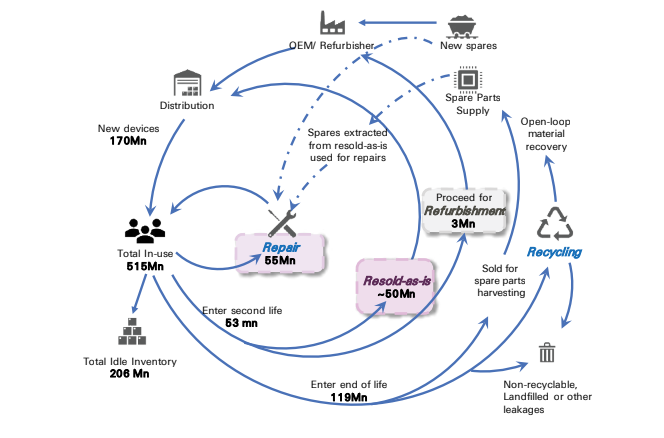

Recover and Recycle, which is a highly competitive informal sector manages approximately 90% of collection and 70% of recycling activities. The formal sector recycles just 22% of collected Waste Electrical and Electronic Equipment (WEEE), owing to small-scale fragmentation and a lack of technical know-how for difficult-to-recycle fractions. Furthermore, the recovered secondary components are lacking in both quality and quantity. In reality, fraudulent activity including coordination between formal recyclers and informal collectors has been observed. The remaining 8% of WEEE is mishandled, such as when it is dumped or leaks into the environment. Idle inventory is another significant barrier, with over 200 million useless gadgets held in Indian households at any given moment.

Approximately 60% of gadgets in need of repair are serviced by a low-cost and easily accessible informal sector, particularly for devices that are no longer under warranty. Consumers who value service quality choose formal sector repairs, which account for 18% of overall demand and are mostly related to in-warranty repairs. The remaining 22% of users in need of repair continue to use their gadgets as is. Venture capital investments in multi-brand businesses are enabling quick expansion to overcome the formal repair and refurbishment industry’s present restricted reach.

India imports a large portion of its electronics, and while domestic production is growing and design is becoming more important, working with global suppliers is still essential. An interesting trend is the rise of “Product as a Service” (PaaS), which lets businesses rent equipment like laptops instead of buying them. This model has grown significantly (by 65% last year) but is still new, especially for everyday consumers.

FIGURE 2: CIRCULAR MATERIAL FLOW OF SMARTPHONES AND LAPTOPS IN INDIA

Despite the projected market size reaching $13 billion under existing commitments, substantial opportunities remain unexplored, encompassing wasted embedded value and capacities. Failure to embrace circularity could jeopardise 1-3% of the electronics industry’s EBITDA.

This also estimates an incremental ~$20 billion in economic benefits, the generation of ~132,000 jobs, and a reduction of ~0.6 Mn metric tons of waste and ~2.2 Mn metric tons to emissions reduction by 2035.

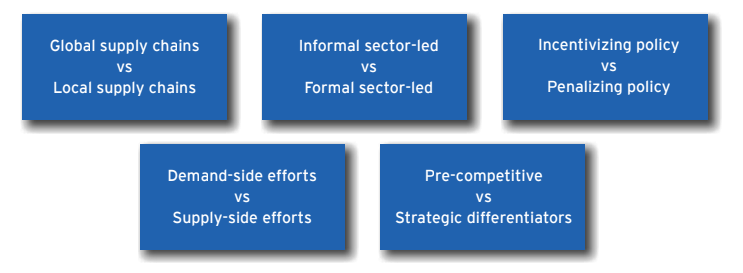

Key Trade-offs and Imperatives:

India’s circular electronics vision confronts five pivotal trade-offs, each demanding careful consideration and strategic balance.

FIGURE 3: FIVE KEY TRADE-OFFS FOR INDIA’S CIRCULAR ELECTRONICS VISION

These trade-offs range from navigating global versus local supply chains to fostering formal sector-led initiatives while preserving the strengths of the informal sector. Prioritizing ease of doing business over stringent regulations and fostering pre-competitive collaboration emerge as critical imperatives to propel India’s circular journey forward.

Challenges and Opportunities:

While circularity has gained traction in India, challenges persist, particularly in the dominance of the informal sector, which manages a significant portion of collection and recycling activities. Informal practices often result in negative environmental and social externalities, necessitating urgent regulatory interventions to mitigate risks and promote responsible recycling practices. However, within these challenges lie immense opportunities to leverage the informal sector’s strengths while fostering formal sector participation through innovative policy measures. Increasing consumer access and awareness of formal collection, Improving formal sector competitiveness with the informal sector, incentivising commercially viable large-scale recycling (incl. metal recovery), and Strengthening demand for secondary material from WEEE are gateways to bring circularity in electronics waste.

9 Game-changing Policy Interventions:

Nine bold policy interventions, spanning downstream, use- phase, and upstream pathways, hold the key to unlocking India’s circular electronics potential. From launching auditable standards to incentivizing high-capacity recycling facilities, each intervention aims to address specific bottlenecks and catalyze systemic change. By enhancing formal sector participation, streamlining supply chains, and promoting circular design principles, these interventions lay the groundwork for sustainable growth and environmental stewardship.

- Launch 3rd party auditable standards and material flow database for collectors, dismantlers, and recyclers.

- Explore public-private mechanisms for formal consumer take-back of devices.

- Develop government-led aggregation and dismantling zones in targeted geographies

- Incentivise high-capacity high yield advanced recycling facilities.

- Scale up multi-brand formal services through strengthened spare parts supply chain, market linkages and incentives.

- Define BIS and industry-led refurbishment standards and mandate aftersales protection options.

- Explore chain-of-custody mechanisms for validating the legality of sourced devices.

- Prioritise the development of the secondary materials market and adopt an ‘ease of doing business lens’ in eco-design consultations.

- Develop a product as a service framework to enable the development of an ecosystem.

Pathways to Systemic Change:

A systemic change approach, characterized by the simultaneous implementation of policy interventions across the value chain, offers a holistic solution to India’s circular electronics challenges. By balancing economic, social, and environmental imperatives and fostering synergies between interventions, India can unlock additional economic value, divert e-waste, and create high-quality green jobs. However, realizing this vision necessitates collaborative action, data-driven policymaking, and unwavering commitment from all stakeholders.

India stands at a pivotal juncture in its quest for circularity in the electronics sector. With the right policy interventions and collaborative efforts, India can harness the full potential of circular electronics, driving sustainable growth, job creation, and environmental conservation. As policymakers, industry players, and civil society join forces, this decade holds immense promise for establishing India as a global leader in circular electronics, setting a precedent for inclusive and resilient economic development.

About the Author:

Shambhavi Singh, Assistant Manager – Public Policy, ICEA

Email: shambhavi@icea.org.in

Amit Kumar, Senior Executive- Environment & Engineering, ICEA.

Email: amit@icea.org.in

I am happy that I found this site, just the right info that I was looking for! .