UNLEASHING INDIA’S POTENTIAL IN IT HARDWARE MANUFACTURING: INTRODUCING PLI 2.0

By Amitesh Kumar Sinha

Electronics are a ubiquitous component of the economy and hold cross-cutting strategic and economic significance in this digital age. It has been the government’s goal to create a conducive environment for manufacturing and to provide incentives to attract large investments to the sector. A substantial increase has taken place in the domestic production of electronic goods over the past few years, growing at a 15% CAGR from USD 49 Billion in 2016- 17 to USD 87.1 Billion in 2022-23. It is also noteworthy that India’s share of global electronics manufacturing has risen from 1.2% in 2014 to 3.75% in FY 2021-22, illustrating its growing influence in this industry.

In the dynamic electronics sector, personal computing devices emerge as a key focus. Research studies underscore how PCs have positively impacted governance, education, and productivity. Despite the rising popularity of smartphones and mobile devices for content consumption and data access, personal computing devices remain essential for content creation. Yet, India’s Personal Computer (PC) penetration lags behind at 15 per 1000 people, a stark contrast to countries like the United States (784 for 1000 people) and China (41 per 1000 people). This disparity brings forth remarkable growth opportunities.

However, the country faces a challenge as IT Hardware manufacturing capability and capacity witness a gradual decline, with numerous units either ceasing operations or operating at low capacities. It’s time to unlock India’s potential in IT Hardware manufacturing and bridge this technological divide for a thriving future.

In a concerted effort to confront these challenges and harness the immense untapped potential, the Government of India unveiled the esteemed Production Linked Incentive Scheme – 2.0 tailored exclusively for the IT Hardware sector. This visionary scheme presents a strategic financial incentive aimed at galvanizing indigenous manufacturing capabilities while concurrently enticing substantial investments across the entire value chain. By embracing this visionary initiative, the government seeks to foster a robust ecosystem that propels the nation’s technological prowess and bolsters its competitive edge on the global stage. The scheme Production Linked Incentive Scheme – 2.0 for IT Hardware (PLI 2.0 gives emphasis on broadening and deepening electronics manufacturing and introduces incentives on an optional basis for sourcing additional components/sub-assemblies made in India including chipsets and creating an enabling environment for the industry to compete globally.

Our focus is on the Target Segment, comprising Laptops, Tablets, All-in- One PCs, Servers, and Ultra Small Form Factor (USFF) devices. Through a budget outlay of INR 17,000 crore, we intend to incentivize the net incremental sales of manufactured goods in these categories, directly bolstering our domestic manufacturing ecosystem.

The tenure of PLI 2.0 spans six years, with applicants having the flexibility to commence operations starting from either 1st July 2023, 1st April 2024, or 1st April 2025. The base year for incremental sales will be the fiscal year (FY) 2022-23, but this can be adjusted to FY 2023-24 or FY 2024- 25 for later applicants.

PLI 2.0 realizes the reality of contract manufacturing, therefore, the applicants are also allowed to count incremental investment done by manufacturers of components/ sub-assemblies etc. for meeting the incremental investment thresholds for individual years, provided it is established that such manufacturer is exclusively manufacturing components/sub-assemblies for the applicants.

A combined ranking system shortlisted applicants based on their revenue (including a group of companies) in FY 2021-22 for the ESDM / Target Segment. The number of applicants shortlisted are subject to the availability of our budget.

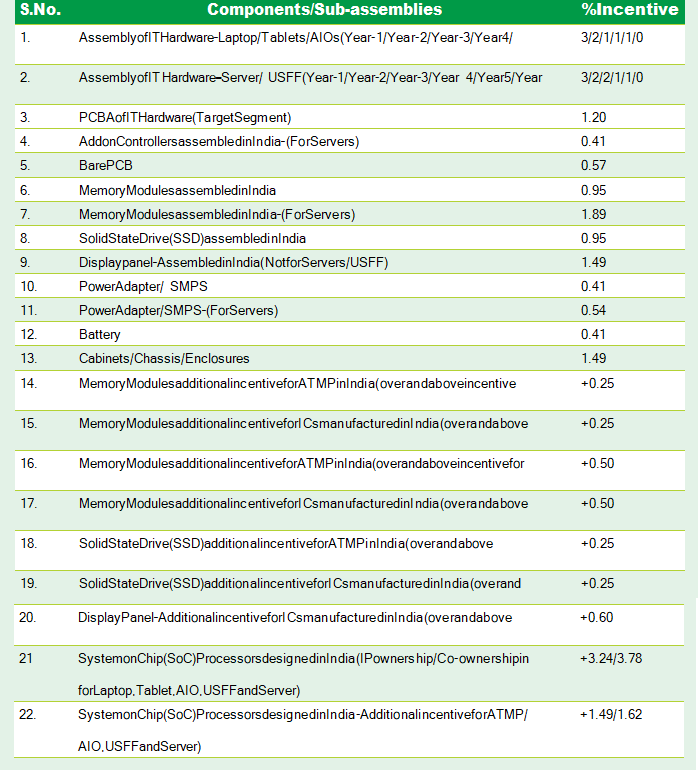

A key highlight of PLI 2.0 is the emphasis on localization. We are offering an average incentive of around 5% for the localization of items, including semiconductor components and sub-assemblies like SSDs, Memory modules, and display panels. This push towards localization will also require applicants to localize Printed Circuit Board Assembly (PCBA) and Assembly during the first year, with at least one additional component or sub-assembly localized every subsequent year.

Furthermore, companies that applied under the first PLI scheme have the option to migrate to PLI 2.0. They can either continue in the existing scheme, transition to PLI 2.0 starting from the 2nd or 3rd year or participate as new applicants for six years, with the investment made under the existing scheme not being counted in the latter case.

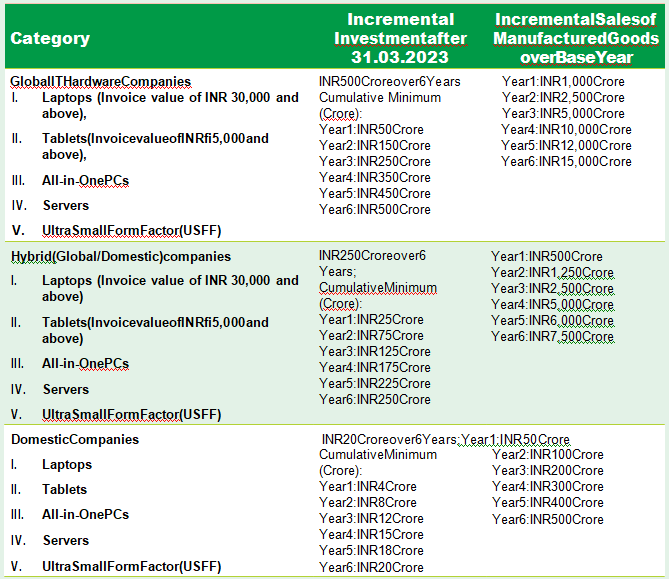

To accommodate a range of entities, we have created three categories of applicants: Global, Hybrid (Global/ Domestic), and Domestic. The year- wise Investment and Incremental Sales details are available in Annexure I.

We have provided a relaxation on investment thresholds, allowing a shortfall in investment by up to 40% in a particular year, with a proportional reduction in the PLI. Applicants will also need to provide year-wise and overall PLI projections for the scheme period, which will act as a ceiling for the calculation of incentives.

The annual incentive projection provided by the applicant shall become the annual ceiling of incentive for the respective financial year. To bring discipline in the projections and ensure realistic targets, Discipline penalties have been introduced to ensure scheme adherence. If the actual PLI amount for a year is less by 25%-50% than the projected amount, there will be a penalty of 5%. If the shortfall is more than 50%, the penalty increases to 10%.

Finally, an incentive ceiling has been set: ₹4,500 Crore for Global companies, ₹2,250 Crore for Hybrid (Global/Domestic) companies, and ₹500 Crore for Domestic companies.

Any incentive above the ceiling for a particular year is subject to unutilized incentive availability.

To summarize, PLI 2.0 transcends mere classification as a scheme; it represents a strategic paradigm shift in India’s IT Hardware landscape, a robust mechanism that shall amplify domestic manufacturing prowess, and a pivotal milestone propelling us towards ascendancy as a formidable digital and manufacturing force. With the domestic production of electronic goods projected to soar significantly, reaching approximately USD 300 billion by FY 2026, it becomes imperative for India to curtail the escalating foreign exchange outflow stemming from electronics imports. Hence, PLI 2.0 assumes the character of not merely a scheme, but rather an indispensable imperative to uphold India’s economic stability and elevate its stature in the global IT hardware arena. We eagerly await witnessing the transformative impact of PLI 2.0 on our IT hardware sector and the broader economy, solidifying our position on the global stage.

For a detailed breakdown of the Year-wise category-wise incremental investment and incremental sales, please refer to Annexure I.

For a comprehensive list of items for localisation, please refer to Annexure II.

ANNEXURE I: YEAR-WISE CATEGORY-WISE INCREMENTAL INVESTMENT AND INCREMENTAL SALES

ANNEXURE II : ITEMS FOR LOCALISATION

Note: The Incentive percentage mentioned in the above table is for Year 1 for items listed from Sr. No.3 to 22. The incentive percentage of Items 2 to 13 shall taper down by 5%, 10%, 15%, 20% and 25% in Year 2, 3, 4, 5 and 6 respectively.

For more information, please contact:

- Nirmod Kumar, Director, MeitY (Mail: nirmod.kumar@meity.gov. in)

- Dr. Atif Faiz Khan, Scientist E, MeitY (E: af.khan@meity.gov.in)

- Harsh Gupta, Dy. General Manager, IFCI (E: harsh.gupta@ ifciltd.com)

- Nitin Sharma, Sr. Consultant, MeitY (E: nitin.sharma91@ govconsultant.in)

- Sachin Singhal, Scientist B, MeitY, (E: sachin.singhal@meity. gov.in)

Shri Amitesh Kumar Sinha is Former Joint Secretary, Ministry of Electronics and Information Technology, Government of India