TEMPERED GLASS SCREEN PROTECTORS: Formalizing the Mobile Accessories Industry in India with Quality Standards

By M. Devendranath

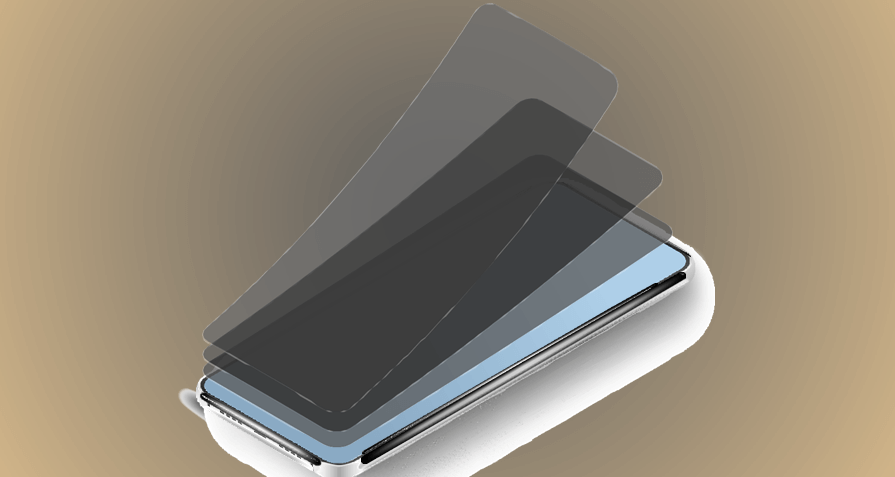

Displays and touch panels are critical components in the functionality of a wide range of handheld devices: smartphones, tablets, medical devices, point-of-sale terminals, and more. A screen protector is an additional sheet of material – mostly Tempered Glass or others. A Screen Protector is akin to an “Insurance Policy” for any Smart ICT Product and protects the most important feature of these products – Displays.

Chemically Tempered Glass Screen Protectors (TG-SP) are the most used Screen Protectors on Mobile Phones due to their many technical advantages and low cost. There are many advantages of TG-SP which include protection from scratches which otherwise weakens the Display/Touch Panel Glass, protection from impact damage from falls or drops, easy and low-cost replacement, and they also provide a better resale value of Mobiles due to the protected displays.

Screen Protectors are one of the important and a large part of the Mobile Accessories market worldwide. It accounts for nearly 20% of the USD 225 Billion (in 2018) worldwide market. Nearly 70% of Screen Protectors are Chemically Tempered Glass. The global screen protective film market is expected to grow at a CAGR of 7% between 2020 and 2028 from USD 43.15 Billion to USD 76.64 billion.

The demand for TG-SP in 2020 was estimated based on sales of Smartphones in 2020 in addition to the replacement demand from Smartphone sales in the 2017-2019 period. The demand for TG Screen Protectors for 2020 was estimated at 342.35 million pieces.

A market with such a large demand has no established players supplying Tempered Glass Screen Protectors in India. The Screen Protectors market is dominated by a host of Brands with some known International Brands and a host of unknown brands and many of them are of inferior / sub-standard/poor quality. Most of the business (~90%) in Tempered Glass Screen Protectors are happening in the “Grey” market. There is a small portion of the market sold through E-commerce Channels which is formalized in the sense that there is a GST which is applied on the sale of these products, the rest are sold through roadside shops and mobile accessory shops in a mostly unorganized way.

It is estimated that the market for Tempered Glass Screen Protectors in 2020 was around INR 5,100 Crores (based on the Supplier’s Sales Prices) and ~INR 15,400 crores (based on the MRP). At this level, since the market is a highly “Grey” market, there is a severe loss (~INR 2,773 Crore) to the Nation in terms of GST revenues.

Apart from the GST, as this business is done purely on cash trading and without bills, there are also other revenue losses to the nation through loss of Income Tax and Customs Duty. There is also a lack of employment which is not being generated by such a large industry in India in a formal way. Most importantly, Mobile consumers in India are being provided with spurious/sub-standard products.

The opportunity which the Tempered Glass Screen Protectors industry presents India is to be viewed from two perspectives:

1- Huge Domestic market for Tempered Glass Screen Protectors and the benefits thereof.

The future of the Tempered Glass Screen Protectors market is directly dependent on smartphone sales in India. The TG-SP demand in India is likely to grow at a CAGR of 10% from the current (2021) 342.35 million pieces to 554 million pieces in 2025 and in value terms, it is estimated to reach ~INR 25,000 Crore (USD 3.4 Billion) at consumer price.

There is a crying need to regularize this industry with quality standards and ensure that ‘Sub-standard’ TG-Screen Protectors are not made or imported and sold in the country. Once there is a level of standardization that comes through, then the local manufacturers will be forced to sell through proper channels to claim GST credits and there is a possibility of formalizing the entire supply chain.

There is a need for the Government of India to bring in BIS Standards for Screen Protectors and these BIS standards should be made mandatory for all Screen Protectors made in India or imported and sold in India.

Some of the possible standards may include:

- The method of testing using a ‘Surface Stress Meter’ equipment or equivalent should be made mandatory for all manufacturers in India making Screen Protectors.

- All Imported Screen Protectors should also be mandated to undergo such tests and get BIS approval on the products to be sold in India.

- Ensure the manufacturer / supplier responsibility there should be a mandatory ‘Fog marking / etching’ on the glass itself indicating the name / logo of the manufacturer / brand of the TG Screen Protector, similar to those markings on the Spectacle lens.

- The Recommended Ǫuality Standards for Tempered Glass Screen Protectors should be to measure the degree of chemical tempering measured by the magnitude of Compressive Stresses (CS) and the depth of the compressive stress layer (also called Depth of Layer (DOL)). The suggested acceptable minimum quality standards for the right Tempered Glass Screen Protectors can be:

- Compressive Stresses (CS): Minimum of 600 Mpa

- Depth Of Layer, or DOL: Minimum of 6 um

The potential gain of GST revenues to the Government of India will reach ~INR 4,500 Cr (USD 0.6 B) by 2025 or a cumulative gain to the nation is likely to be ~INR 18,500 Cr (USD 2.6 B) in the next 5 years, between 2021 to 2025.

2- Opportunities for India to participate in the Global Market through Exports

If quality manufacturing is encouraged with the right standards and the right firms are invited to make it in India, Tempered Glass Screen Protectors could be exported from the country. At the initial stage (for the next 5 years), India could attempt to gain a 15% global market share in the next 5 years with the global market expected to grow to USD 76.64 billion by 2028.

The current leading manufacturers in the global smartphone screen protector market include Nippon Electric Glass, Shenzhen Yoobao Technology, FeYong Digital Technology Limited, NuShield, IntelliARMOR, Clarivue, Corning Inc., Harito, Protek, ZAGG Inc., Belkin International, and Xtreme Guard.

India could potentially look at Exports of TG-SP to the tune of 951 million pieces or INR 20,300 crores (USD 2.7 B) by 2025 or a cumulative of ~INR 40,000 Crores (USD 5.4 B) between 2022 and 2025 with Ǫuality manufacturing from India.

This large Tempered Glass Screen Protectors market (if formalized) is likely to bring in a lot of other benefits for the nation such as improving the country’s image as a quality products manufacturing base and also could lead to a very high employment generation to the tune of 25,000 direct employment and ~75,000 indirect employment.

About The Author-

M. Devendranath is the CEO and a key member of the Executive Council at Feedback Advisory. He has advised a host of Indian and International Corporations in Energy and Electricals & Electronics Businesses – Semiconductors, Electronics, Electronic Components, EMS Business, Electric Vehicles, Solar, NG Based Power Plants, Biomass Power, Distributed Power Plants, Wind Energy, Energy from Municipal Solid Waste.