India’s Opportunity to be a Global Leader in the Hearable and Wearable Sector

By Surbhi Jain & Rishabh Ahuja

Hearables and wearables could be a key contributor to the government’s goal of achieving USD 300 billion in domestic electronics production by 2025-26. Indian firms, supported by Production Linked Incentives (PLI) and economies of scale, will be propelled to take off as global leaders in this sector.

India’s electronics manufacturing moment is here. The country has become the second-largest mobile manufacturer in the world and in 2022-23, India exported more than INR 90,000 crore worth of mobile phones. The government’s Phased Manufacturing Programme (PMP) and the PLI Scheme for Mobile Phones have been key to this success. Under the Government of India’s vision, India plans to achieve USD 300 billion in domestic electronics production by 2025-26. The country’s burgeoning hearables and wearables industry could contribute significantly to that target. To that end, PLI schemes are the need of the hour.

Market Dynamics of the Hearable and Wearable Sector

In 2022, the hearables and wearables global market was around USD 70.4 billion (comprising more than 500 million units) and is expected to reach USD 84.6 billion by 2026. The Indian market exited 2022 with a strong 46.9% YoY (year-over-year) growth. The volume increased to more than 100 million units worth USD 2.8 billion in 2022 and is expected to grow to 133.5 million units, worth USD 3.2 billion by 2025-26.

Some market factors driving growth in this product segment include changing lifestyles, rising incomes, and improved living standards, which are moving consumers to spend more. Further more, the market has chances for growth due to technical developments, and increased availability of low-cost, high-quality products.

India is a large- volume and low- value market in nature. In comparison to the Rest of the World’s average selling price (ASP), the Indian market ASP is nearly 1/4th the global market ASP. At the same time, it is estimated that in 2022, India’s domestic demand was more than 19% of the global demand in terms of volume. In fact, India is one of the fastest-growing Earphones markets in the world accounting for a 21% share in Global Volumes and only a 5% share in Global Value.

In the 2025-26 vision, hearables and wearables production is estimated at USD 8 billion with massive export potential.

India’s Progress in Manufacturing Hearables and Wearables

As with other electronics, the government introduced the Phased Manufacturing Program for the hearable-wearable industry in Feb 2022. While the PMP’s results are gradual, India is building capacity to satisfy the domestic demand and capitalise on export potential.

About 70-80% of the demand for wearables such as smartwatches and hearables like wireless earphones in India is now being met through local manufacturing afterthegovernment launched the PMP for the sector and slashed duties on most of the components required to make the products.

With no production in FY2020-21, the production of wearables and hearables in India has increased from USD 250 million in 2021-22 to USD 1 billion in 2022-23.

Several Indian brands have also risen to dominate the domestic market. Among the top five wearable brands in India, the top three are Indian brands – Imagine Marketing (BoAt), Nexxbase (Noise), and Fire-Boltt.

Why PLI is the need of the hour?

While the duty differential on importing finished products will spur local production going ahead, several issues remain that hamper potentially meteoric rise in manufacturing wearable and hearable products locally. A complimentary (PLI) scheme could help to tackle many of these.

Reasons for PLIH & W

- Address the cost disabilities in India

- Create economies of scale and global champions

- Increase DVA

- Generate Employment

Address the cost disabilities in comparison to Vietnam and China As per industry estimates, manufacturing in India still faces a cost disability of 8-10% for hearables / wearables as compared to China and Vietnam, requiring a focused intervention.

Create Economies of Scale

The PLI scheme, with emphasis on exports and capturing the global market, can create economies of scale in India for hearables and wearables, enabling the creation of global champions and following the clarion call of the Hon’ble Prime Minister of ‘Make in India for the World’.

Increase Domestic Value Addition

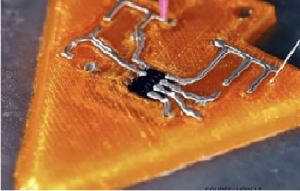

This Production-Linked Incentive (PLI) Scheme can propel the deepening of the local manufacturing ecosystem by playing a complementary role to the other PLI schemes in Components, Mobiles, as well as IT Hardware, incentivising manufacturers to localize the components, starting with PCB assembly and then moving towards the localisation of batteries and displays as well. This can lead to a huge increase in domestic value addition and transform India’s manufacturing sector.

Employment Generation and Economic Multiplier

Hearables and wear able assembly have a higher workforce- to- turnover ratio of 4:1.This means more people can be employed in this sector compared to mobile or IT hardware in terms of the ratio of volumes. employment. This makes the segment an attractive choice for job creation. Further more, the omnipresence of Indian brands in the sector creates a lever for domestic local product design and testing infrastructure. Thereby also addressing some of India’s global market challenges, such as research and development, technology transfer, creating a deep electronics manufacturing ecosystem, and the benefits of resilient value chains in the electronics ecosystem.

In summary, the Production-Linked Incentive (PLI) Scheme focused on hearables and wearables in India can unlock the sector’s immense potential. By creating an economy of scale, incentivising the localisation of components, and focusing on job creation, the scheme can transform India’s manufacturing sector and make it a formidable force in the global market.

Authors

Surbhi Jain brings a wealth of experience in Corporate Communication, and Public Policy in South and South East Asia, specifically in the telecoms sector, manufacturing, and international trade. Her expertise in global value chains has been instrumental in leading the diversification of electronics manufacturing from China to South Asia.

Rishabh Ahuja works with the India Cellular & Electronics Association (ICEA), to bridge the gap between the private sector and the government to establish India as a global electronics manufacturing hub. He is a alumnus of the Indian School of Public Policy (ISPP).

I like this web site very much so much excellent information.