Fast and Furious Road map for Value Added Electronics Manufacturing

By Niju Vijayan

The transformation potential of electronics in India’s economic development through consumption, innovation, manufacturing and exports is now widely recognized. Local manufacturing of products and components takes centre stage as the enabling environment evolves to address opportunities. The importance of electronics manufacturing has taken a firm hold on the collective psyche of the stakeholders ranging from industry participants to investors to policymakers and even the aspiring students’ community. The goal of USD 300 billion industry size by 2026 is not just exciting but appears achievable too. Mobile handset production trajectory over the last 8 years has in stilled belief in other electronic segments to replicate the success and become globally competitive. The size of the opportunity is compelling but India’s current level of electronics value addition ranges from 15-25% and places it among the lower rungs of manufacturing countries. The presence of a large number of captive design centres engaged in cutting- edge development is no consolation as they operate as low-cost fuelled satellite centres for the global majors.

The global economic churn which started during the pandemic and continues unabated due to political factors has firmly placed India in an enviable position. The Global Value Chains reconfiguration is far from settled and investors are constantly searching for safer alternatives for manufacturing.

As India actively invites assembly activities to migrate from other locations, it feeds into the cautionary voices of the perils of increasing low- value manufacturing. Apprehensions are also raised on the longevity of the competitive edge enjoyed by India after the incentive policies move into the sunset. In the race to attract investment and build the electronics industry, many countries follow copybook practices and hence this argument is not devoid of merit. At the same time, the position enjoyed by India bestows it with unmatched advantages in the long term.

The domestic consumption driven by the 1.4 billion population is the strongest pillar that acts as a magnet for product manufacturers. India’s thrust on digitization through strategic infrastructure development is acting as a force multiplier for greater adoption of products and services. Given the competitive character and need to control logistics costs, manufacturers need geographic proximity. The vast pool of human capital at a highly competitive cost helps brings down the cost of production significantly for global players. Empirical data on the industry is sufficient to prove the success of global players in not just assembly activities but scaling them to become global supply centres too.

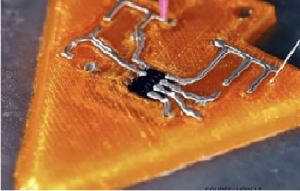

So, how fast and furious should India’s roadmap from assembly to component-level manufacturing be, in order to create a durable global manufacturing hub? Well, the answer may not be complicated. The runway to create a globally competitive electronics ecosystem could stretch between 7 to 10 years, considering all elements work in unison. There is a sense of urgency because revolutionary developments are taking place in communications (5G/6G), electric mobility, drones, AR/VR etc, where white space beckons India. Assembly activities undoubtedly will exhibit dependence on imported components but this layer will stimulate localization of components manufacturing and eventually design. If the government and industry work in tandem, the large-scale assembly will bear fruit in 3-5 years while its feeder components manufacturingcanbecomeviablein5-8years.Itneedstobeborne in mind that the current push by the government can fructify in a semiconductor fab by 2026.

A few critical elements for a durable and rewarding industry are skills and local design contribution. Skills are a direct factor of industry maturity and it’s apparent that skills development has a long way to go in India. The availability of semi-skilled manpower is sufficient to address the manpower-intensive assembly activities, but industry handholding and targeted programs can address mid to high-end skills as the industry elevates it self 5 years from now. The catchment area for high-end design activities also needs to be enlarged for an uninterrupted supply. The risk of flight of manufacturing can be effectively restricted if local design and IP are created across applications. Local IP will not just moor the manufacturing in India but enable the exploration of adjacencies that will have a multiplier effect. The focus on fabless design companies needs to ensure that this segment becomes a force to reckon with over the next 7 years.

Hence there is no ambiguity that the current path adopted by India to intensify assembly activities bodes well for the future. This game plan must undeniably include the plot for transforming the industry into a design-led manufacturing one, at a furious pace. India has chosen to grow its electronics industry into a key contributor to GDP and there can’t be complacency. As Ginni Rometty, ex-CEO of IBM once commented: “Growth and comfort do not coexist.”

Author

Niju Vijayan is a Partner with Avanteum Advisors LLP., a Business Advisory firm.